Ethereum Over $3,600 As Odds Of Ethereum ETF Approval Rise

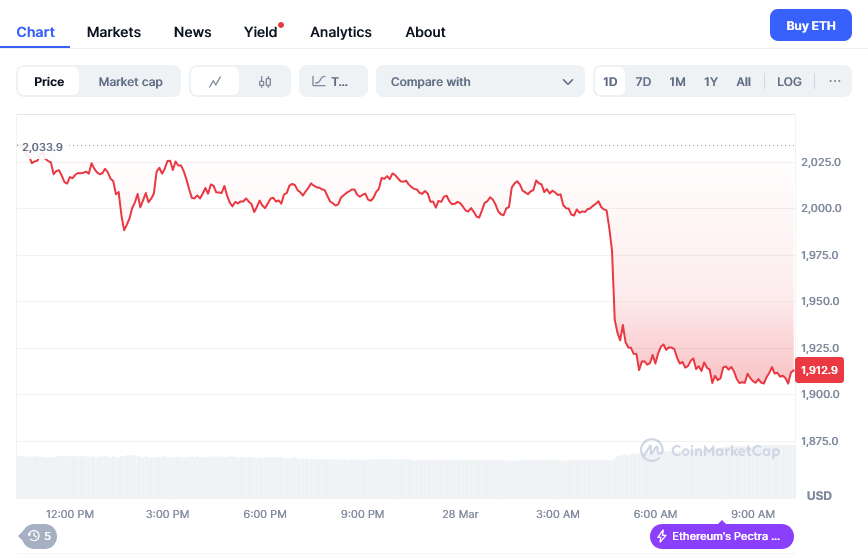

Ethereum (ETH) has surpassed $3,500 following news that the SEC will likely greenlight a number of spot Ethereum exchange-traded funds (ETFs). According to CoinGecko’s data, ETH is currently trading at around $3,552, up around 16% in the last 24 hours.

Meanwhile, Bitcoin (BTC) broke through $70,000, setting eyes on a new all-time high.

Bloomberg senior ETF analysts Eric Balchunas and James Seyffart have predicted a 70% chance that the U.S. Securities and Exchange Commission (SEC) will approve spot Ethereum ETFs.

Previously, both analysts commented on the very low approval rate, noting that the SEC hadn’t shown much engagement with the ETF issuers, which is different from what the agency did during the spot Bitcoin ETF review process.

The Rally Is Here

According to Balchunas, the SEC might consider greenlighting spot Ethereum funds under political pressure. His earlier estimate for approval was 25%.

Seyffart made a joking remark on X about being criticized by Ethereum enthusiasts. He acknowledged that he and Balchunas might have previously given the impression of a more pessimistic outlook, which led to some disappointment.

“Never gonna hear the end of this from the eth people in my replies if this turns out to be true. But it’s what we’re hearing from multiple sources. Should see a bunch of filings over coming days if we’re correct,” Seyffart commented.

Additional information from Fox journalist Eleanor Terret has also fueled the positive development of these spot ETFs. Terret noted that an ETF issuer source said “things are evolving in real time” with Ethereum ETFs.

ETH ETF Coming?

The latest development is a U-turn compared to previous weeks’ projections. Even ETF issuers placed bets on an outright denial.

VanEck CEO Jan van Eck said in an interview with CNBC that the SEC might first reject VanEck’s and ARK Invest’s spot Ethereum ETF filings. Last week, Bitwise’s legal counsel Katherine Dowling told Bloomberg that the fund manager was bracing for rejection due to the lack of activities in the lead up to the SEC verdict.

According to a report published last week by Coinbase’s research team, the odds of spot Ethereum ETF approval are between 30% and 40%.

Analyst David Han suggested that the SEC might reject products that include a staking component due to unclear regulations surrounding the Proof-of-Stake concept. However, he believes it may not affect those that do not come with staking.

The Odds Are Up!

The odds of spot Ethereum ETF approval suddenly move higher as exchanges seeking to list and trade shares of Ethereum ETFs reportedly received a sudden request from the SEC to update their filings.

For an ETF to be approved and begin trading, the issuer needs the SEC to approve two applications: a 19b-4 application and an S-1 application. In the case of the Bitcoin ETF, both applications were approved around the same time, allowing trading to commence just a few days later.

This difference in approval timelines has led to speculation about the SEC’s intentions. There are speculations that the SEC doesn’t want to upset the crypto community by outright rejecting spot Ethereum ETFs.

At the same time, the SEC might still have concerns about allowing the products. There are ongoing talks about the exchange’s uncertain stance on the underlying product of the fund, Ethereum. It was previously reported that the securities agency had launched a legal campaign to classify Ether as a security.

This potential classification may be one of the key factors that lead to a denial. According to Van Buren Capital partner Scott Johnsson, spot Ethereum ETFs might not be allowed, given this potential classification.

The possibility is that the SEC could approve the 19b-4 for the general product but delay the approval of any specific S-1 applications from issuers.

The post Ethereum Over $3,600 As Odds Of Ethereum ETF Approval Rise appeared first on Blockonomi.