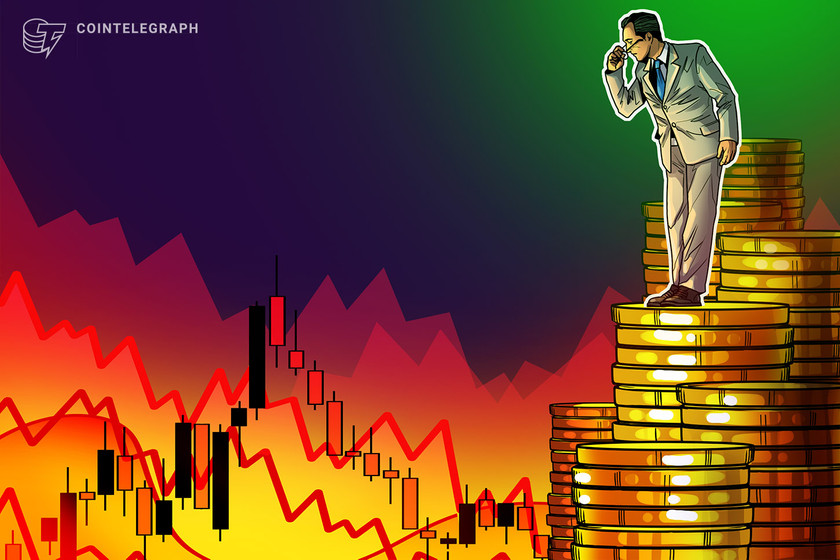

A recession is coming — Here’s how it’s fueling Bitcoin

Cointelegraph analyst and writer Marcel Pechman explains how a potential looming recession might be causing Bitcoin’s price to rise.

The show Macro Markets, hosted by crypto analyst Marcel Pechman, which airs every Friday on the Cointelegraph Markets & Research YouTube channel, explains complex concepts in layman’s terms and focuses on the cause and effect of traditional financial events on the day-to-day crypto activity.

The International Monetary Fund (IMF) and the United States Federal Reserve foresee an impending economic recession, which is the topic of today’s episode by crypto analyst Pechman. The video explains how the U.S.’s record-low unemployment rate could be hiding a bigger issue caused by inflation.

Pechman explains that the S&P 500 being only 13% below its all-time high has been driven by investors moving away from fixed income and why inflation is no longer a primary concern. Finally, there’s the link between the banking crisis, a weaker U.S. dollar and Bitcoin’s recent rally above $30,000.

The next segment of Macro Markets focuses on the bank’s leverage ratio. There’s a growing concern that financial institutions are lacking the capital to cover their risks, but that’s not what the most recent data has shown. The culprit, in Pechman’s view, is unrealized losses. Basically, banks are holding debt instruments that are paying way below their cost of capital.

If you are looking for exclusive and valuable content provided by leading crypto analysts and experts, make sure to subscribe to the Cointelegraph Markets & Research YouTube channel. Join us at Macro Markets every Friday.